A question we are constantly asked this time of year is how should you treat staff Christmas parties and gifts in the lead up to the holidays? This can be a complex issue. For most businesses, there are really three questions you need to consider.

- Is the cost tax-deductible to your business?

- Is the benefit provided to your employees or their associates (e.g. spouse) subject to Fringe Benefits Tax (FBT)?

- Can you claim GST on the costs incurred?

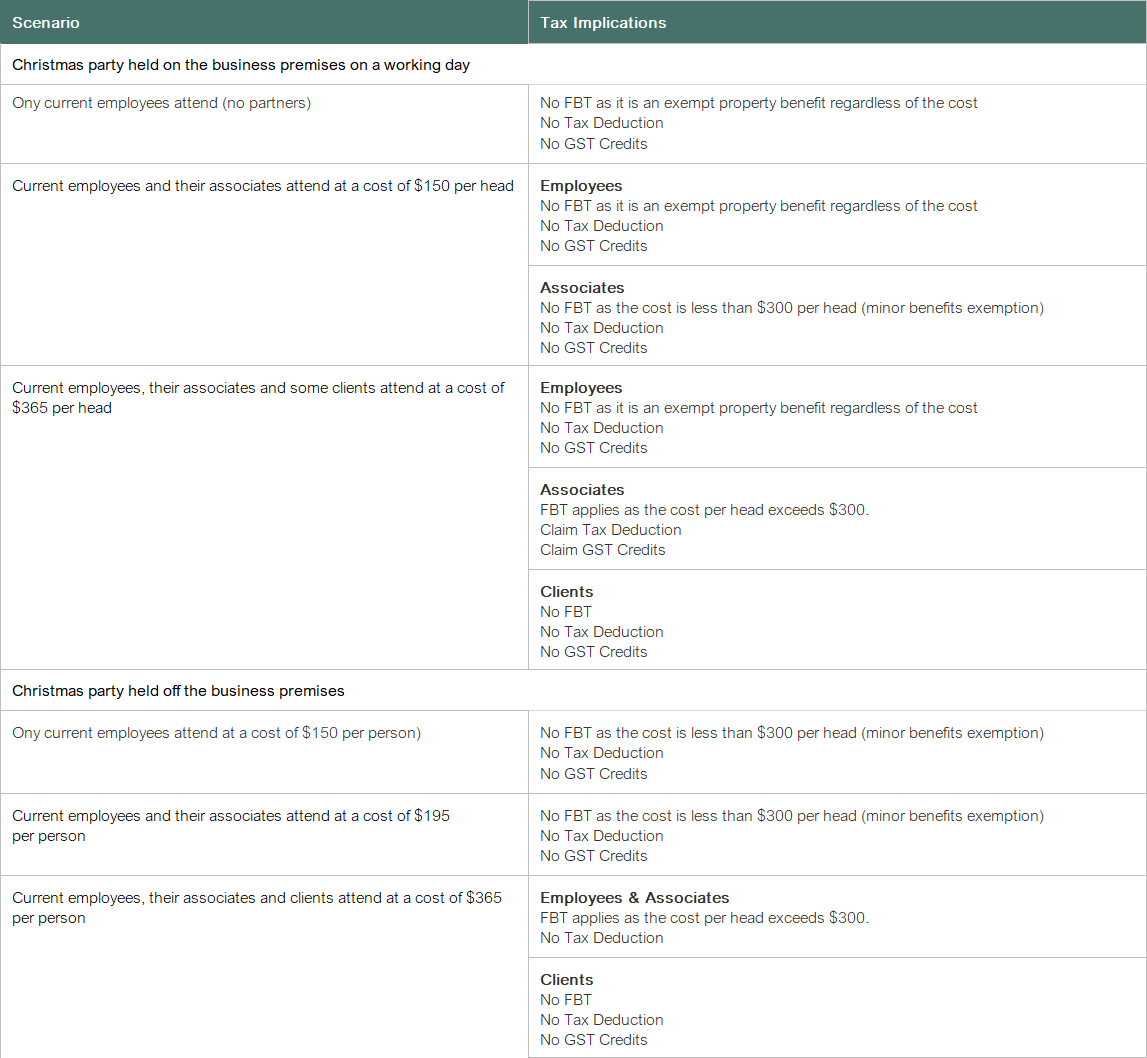

Christmas Parties

No matter how you look at it, the cost of an employee or their associate (spouse) attending a Christmas party will invariably always be a form of “entertainment”.

Normally, Fringe Benefits Tax (FBT) is payable by the employer on the value of the entertainment provided. However there is an exception. Provided, the benefit is less than $300 (incl. GST) and is “infrequent” or “irregular” and not a reward for services, then the benefit can be treated as an exempt minor benefit.

On the flip side, because these entertainment expenses are not subject to FBT, they are also not tax deductible. That’s right – unless you are spending more than $300 a head, it means that expenses incurred in providing a Christmas party are not generally deductible. And you cant claim any GST either!

Here is a table to summarise:

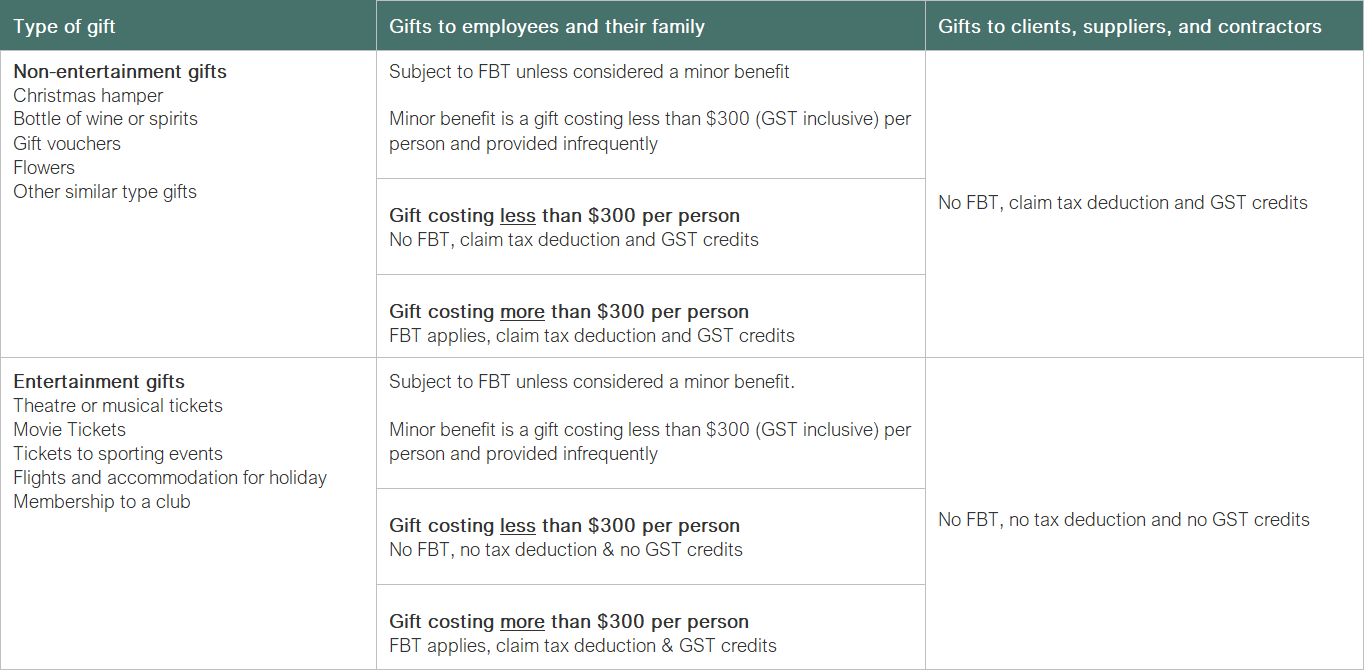

Christmas Gifts

Generally, the best tax outcome for businesses is to give employees non-entertainment type gifts that cost less than $300 (inclusive of GST) per employee. The cost is fully tax deductible, with no FBT payable and full GST credits can be claimed. This is provided the gift is not given to the employees wholly or principally as a reward for their services rendered.

Unlike non-entertainment gifts, gifts classified as entertainment, including recreation, are non-deductible and GST credits cannot be claimed. A tax deduction and GST credits can only be claimed on entertainment or recreation gifts where Fringe Benefit Tax applies. This means that while the minor and infrequent exemption could still apply for entertainment and recreation gifts costing less than $300 (GST inclusive), tax deductions and GST credits can only be claimed where FBT applies to entertainment and recreation gifts.